Written by Timothy Perry | April 16, 2025

So... another dreaded Tax Day has passed, and you still haven’t filed your taxes.

Maybe it’s been one year. Maybe two. Maybe ten.

You’re not alone — and you’re not out of options.

At Carolina Tax Resolutions, we talk to people every day who feel overwhelmed, as ....

Read More >

Friday, April 19, 2024 Written by Timothy Perry

As Tax Day came and went earlier this week, many individuals breathed a sigh of relief after filing for an extension. But for some, that extension can lead to a moment of truth: realizing you owe more to the IRS or the North Carolina De ....

Read More >

Monday, January 29, 2024 Written by Timothy Perry

In a groundbreaking move, the Internal Revenue Service (IRS) has announced a game-changing initiative to forgive nearly $1 billion in late-payment penalties for millions of American taxpayers. This comes as a relief for individuals who have found t ....

Read More >

Wednesday, May 25, 2022 By Timothy Perry

Equifax, Experian, and TransUnion made significant changes to the way they report (or don’t report) medical collection accounts

1. After July 1, 2022, medical debt that was sent to collections but later paid will n ....

Read More >

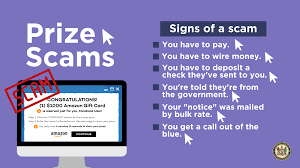

CONSUMER ALERT

Watch Out for Prize Scams Targeting North Carolinians

Thursday, April 14, 2022

Our office has received a report of scammers claiming to be from the North Carolina Department of Health and Human Services (DHHS) contacting North Carolinians on Facebook to try to steal their money. The scammers claim to be DHHS emplo ....

Read More >

Thursday, April 14, 2022 - written by Timothy Perry

Surprisingly, there is not a clear-cut answer to this common quandary. If you are as fanatical as the O.C.D. plagued Howard Hughes then the answer is likely forever. If you are conservatively cautious and somebody who buys a 2 million dol ....

Read More >

Monday, February 7, 2022 Written by Timothy Perry

The IRS hopes to cut down on tax cheating from people who earn money from “side hustles” and other kinds of work where “cash payments” are more common than more traditional forms of payments. Unlike traditional payme ....

Read More >

Wednesday, January 27, 2022 by Timothy Perry

The floodgates for filing 2021 taxes opened on January 24, 2022, and marks the third tax season significantly disrupted by the Covid-19 pandemic. The IRS Commissioner, Chuck Rettig warned us early on to prepare for a turbulent tax filing season. He said, "in many areas, we are unab ....

Read More >

On January 11th, 2022, the Internal Revenue Service announced that the 2022 tax filing season will start Monday, January 24th, 2022. The IRS will begin accepting federal income tax returns electronically and by mail for the 2021 tax year on this date. This year marks the third tax season during the coronavirus pandemic. Like with the ....

Read More >

March, 2021 By Timothy Perry

The IRS has changed course and finally pushed back this year’s filing deadline considering all the recent legislation that will affect most American’s tax returns.

The Internal Revenue Service has pushed back the traditional April 15th tax-filing and payment deadlines for individuals u ....

Read More >

March 5, 2021 By Timothy Perry

January 28, 2021 - President Joe Biden signed an executive order giving access to affordable healthcare for America’s uninsured through May 15, 2021. This package of health care-related executive orders and other initiatives, reopened the HealthCare.gov web-portal for a special three ....

Read More >

Jan. 26, 2021 By Timothy Perry

Congress approved some year-end tax changes in December as part of the COVID Relief Act that have forced the IRS to push back the start of tax filing season by over 2 weeks. The Internal Revenue’s start date is not until February 12 this year, well beyond the late January date on which they typicall ....

Read More >

January 11th, 2021

Written by: Peyton L. Derrow

Each year, the default tax-filing deadline is April 15 (give or take a few days), and it appears that 2020 tax filings will be no exception. Despite the IRS pushing the 2019 federal income tax filing deadline back three months for taxes due in 2020, it is uncertain that the ....

Read More >

December 28th, 2020 By Timothy Perry

When COVID-19 struck last March, many employers were thrust into a work from home model for their employees. Some of those employee’s took advantage of this newfound geographic freedom as remote workers to temporarily relocate. In some cases, this meant the company they worked for and wh ....

Read More >

November 20, 2020

Written by Peyton L. Derrow

Each year at tax time, thousands of Americans are taken aback by just how much they owe and simply can’t afford to pay. For some taxpayers, especially the self-employed this triggers a cascading effect that goes on for years and is exacerbated by outlandish penalties and interest that q ....

Read More >

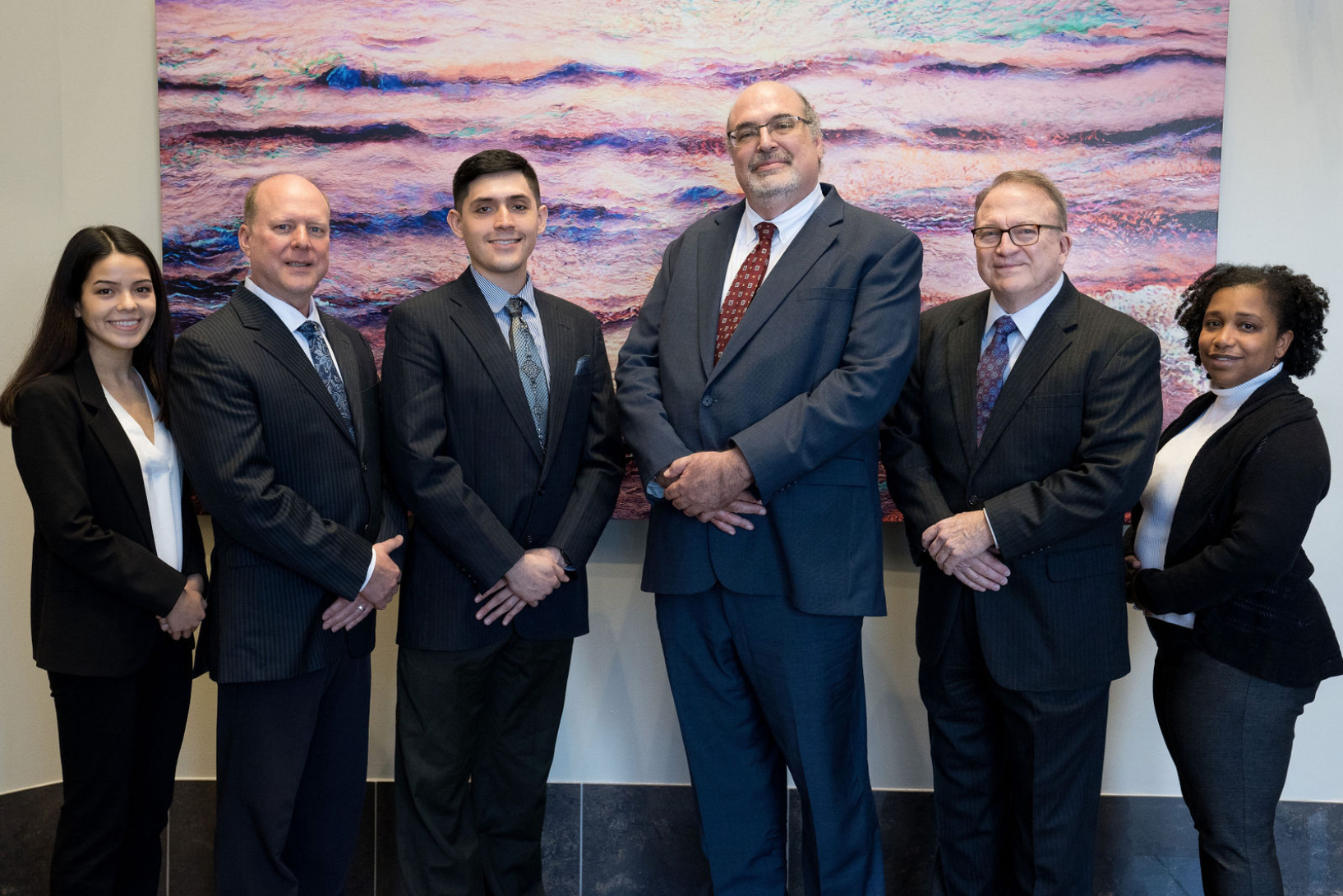

In March 2020, Carolina Tax Resolutions was featured in the NC Triangle edition of the national Attorney at Law Magazine. Our staff sat down with magazine publisher Bob Friedman to discuss what exactly we do and how we help our clients.

You can read our article "Carolina Tax Resolutions: No Magic —Just Honest and Consci ....

Read More >

March 27, 2020 By Timothy Perry

COVID-19 has affected each of our lives and businesses in very different ways. Several communities have now issued stay-at-home orders, including Durham, Orange, and Wake Counties. With the help of our technology, we will be available and our phone lines will re ....

Read More >

Written by Gillian Katsumi

February 6, 2020

What is wage garnishment?

A wage garnishment is an order from a court or government agency that requires your employer to withhold a specific portion of your paycheck and send it directly to the creditor or person to whom you owe money. Your earnings ....

Read More >

Written by Gillian Katsumi

January 20, 2020

Only about one percent of taxpayers are audited each year, but if you're not careful, you may find yourself in that minority. If you receive an audit letter from the IRS, do not panic. Taxpayers should understand that an audit in no way implies ....

Read More >